Morning Report

Morning Report – Friday 10th July

Main Headlines

Chinese large cap shares plunged after two state backed funds trimmed their holdings in a sign Beijing aims to slow a rally that added about $1 trillion to equity values this week alone. In one case, the national pension fund will sell a 2% stake in People’s Insurance Company of China. PICC fell as much as 7.5%, and the SSE 50 Index extended losses.

Asian equities fell with U.S. stock futures as Shanghai’s eight day rally came to a halt and concern resurfaced that rising coronavirus cases will hurt the global economic recovery. European futures are lower as result. Treasuries held on to an overnight gain. Oil slid, with WTI falling below $40 a barrel. Gold slipped just below $1,800 an ounce.

GBP

Risk sensitive currencies slid overnight after a surge in new coronavirus infections in the United States further undermined the case for a quick turnaround in the economy. Sterling is subsequently losing ground going into the weekend.

EUR

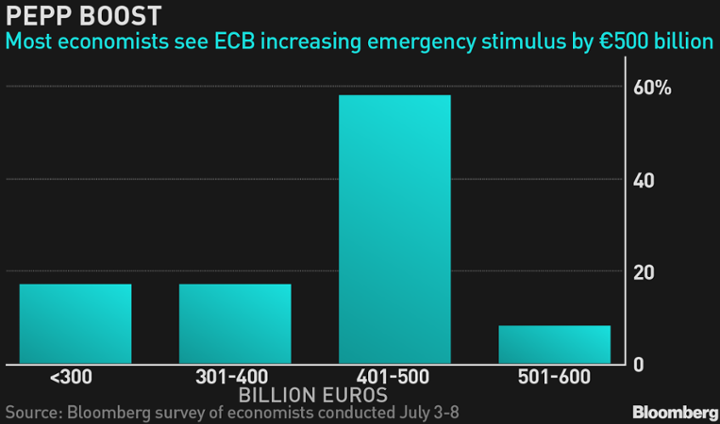

The ECB is expected to expand its bond buying program further, even though some policy makers have said the outlook is improving slightly. More than half of the economists in a survey predicted an increase in the ECB’s 1.35 trillion euro pandemic purchase program by December, with most expecting an extension and a top up of 500 billion euros. The Governing Council is seen holding policy steady next week. The euro has slipped back from one month highs seen yesterday.

USD

Yesterday’s weekly data showed the number of Americans filing for initial jobless benefits dropped to a near four-month low last week. However, with companies from retailers to airlines announcing job cuts and furloughs, the outlook remained highly uncertain. As risk aversion starts to creep back into markets, the dollar is trading positive and is adding to overnight gains.

Main Economic Data/Central Banks/Government (All Times BST)

7:00 a.m.: Norway June CPI, PPI

7:45 a.m.: France May industrial production

8:30 a.m.: Riksbank publishes minutes from June 30 meeting

9:00 a.m.: Italy May industrial production

6:00 p.m.: Baker Hughes U.S. rig count