Morning Report

Morning Report – Tuesday 23rd June

Main Headlines

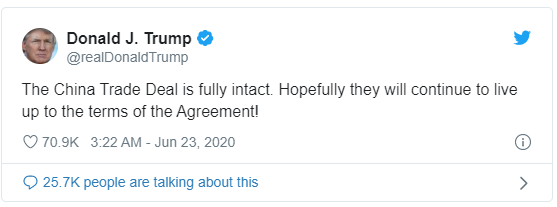

U.S. President Donald Trump said the phase one trade deal with China is “fully intact,” after his adviser Peter Navarro sowed confusion and spurred a temporary stock slump with comments interpreted as a decision to end the agreement. U.S. futures swung wildly with the yuan as the remarks caused concern that the deal signed in January, which paused the trade war between world’s two largest economies, was in jeopardy.

Global markets breathed a sigh of relief. Asian stocks climbed with European futures, while U.S. contracts got back into positive territory. Chinese shares rose and the yuan pared declines. Havens started to give back recent gains and treasuries were mostly steady. Oil recovered most losses.

GBP

Sterling rose on Monday, recovering from a three-week low during Asian trading, helped by a weaker dollar, hopes of a Brexit trade deal and expectations of better economic data. Gains against the euro, however, were limited after British industrial output recorded its biggest quarterly fall on record during the three months to June. Some analysts believe the pound should have gained further, especially after the Bank of England last week reduced expectations for negative rates and slowed the pace of quantitative easing in response to signs of economic recovery.

EUR

The European Union has until the end of the year to sign a new trade agreement with the Britain, when a transition period following its exit from the bloc comes to an end. Although much remains to be discussed, both parties have signalled progress. Last week, French President Emmanuel Macron told British Prime Minister Boris Johnson that France still supported reaching a deal and EU chief Ursula von der Leyen stressed “willingness to undertake all possible efforts to come to an agreement”.

USD

Risk-sensitive currencies bounced back from sharp falls against the dollar overnight after White House trade adviser Peter Navarro said his comments that the trade deal with China was “over” were taken out of context. The market swings reiterate how concerned the markets are about possible deteriorations in U.S.-China relations. Market sentiment is generally positive this week as some big cities in North America, such as New York, easing lockdowns and reopening their economies.

Main Economic Data/Central Banks/Government (All Times BST)

8:00 a.m.: ECB’s de Cos speaks

8:15 a.m.: France June PMIs

8:30 a.m.: Germany June PMIs

9:00 a.m.: Euro-Area June PMIs

9:30 a.m.: U.K. June PMIs

9:45 a.m.: BOE’s Bailey speaks

1:00 p.m.: Hungary rate decision