Morning Report

Morning Report – Friday 2nd October

Main Headlines

Ursula von der Leyen, European Commission President, said that a ‘letter of formal notice’ had been sent to the UK due to the illegal internal market bill. The letter is the first stage of a process that could lead to Britain in front of the European Court of Justice. Despite key differences, Michel Barnier has recently spoken of an improved mood in the talks.

Nancy Pelosi and Steve Mnuchin have continued talks over a pandemic relief package, but there is still no immediate breakthrough. House Democrats passed the fiscal stimulus bill with no Republican support 214-207, but there is still a long way until any bill is passed as both parties have failed to bridge a gap of hundreds of billions of dollars. US stocks have dropped significantly as markets are not confident that a fiscal stimulus bill will be agreed. The S&P 500 has dropped over 1.5%.

Donald and Melanie Trump have tested positive for COVID-19 and must start quarantine, barely a month before the election. The virus was most likely transferred from Hope Hicks, one of the president’s closest advisors, who travelled with Trump to the first presidential debate and campaign rally in Minnesota on Wednesday.

GBP

The pound is trading relatively flat against both the dollar and euro in early morning trading. The final round of talks between the EU and UK is today, and after both sides made limited progress yesterday, it sets up a frantic few weeks of last ditch negotiations and market volatility.

EUR

The euro is down against the dollar and pound in early morning trading, although it is cancelling out some of its losses in recent hours. Michel Barnier continues his negotiations with counterpart David Frost today. Many in the European side are cautiously optimistic a deal will be made over the coming weeks, but it is unlikely any agreement will be finalised today. Boris Johnson has set a deadline of 16th October for a deal, but the EU are willing to wait longer which means Brexit uncertainty is likely to continue for a while yet.

USD

The dollar has climbed against most major currencies this morning, except the Japanese Yen, due to a lack of fiscal stimulus agreement and Donald Trump contracting Coronavirus. Equities have fallen globally as investors are scrambling away from risk-on assets and the dollar is benefitting from the panic. Today the last US jobs report before the election is released and is projected to show a sharp deceleration in labour-market gains. If this is the case, equities are likely to fall lower with the dollar seen as the most likely benefactor.

Main Economic Data/Central Banks/Government (All times BST)

8:00 a.m.: Spain Sept. unemployment

9:20 a.m.: ECB’s Holzmann speaks

10:00 a.m.: Euro-area Sept. inflation

11:00 p.m.: ECB’s De Guindos speaks

2:30pm.: US Non-farm Payrolls

4:00 p.m.: ECB’s Hernandez de Cos speaks

6:00 p.m.: Baker Hughes U.S. Rig Count

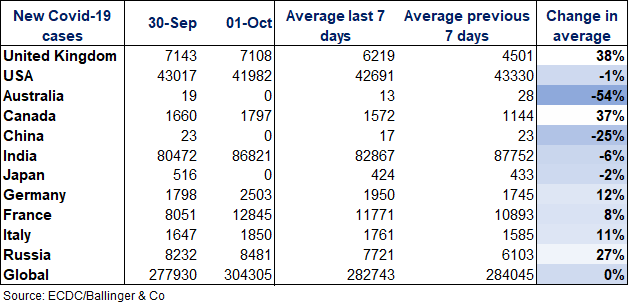

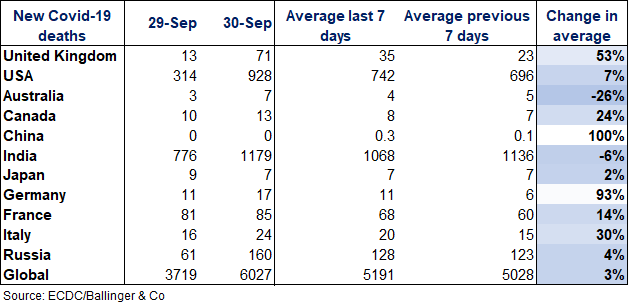

COVID-19 UPDATE